Currently Empty: €0.00

OXE Binary Price Action Algo

- Home

- OXE Binary Price Action Algo

OXE Binary Price Action Algo

Price action refers to the movement of a security’s price and is encompassed in technical analysis. For example, a trader might say that a security’s price action lends credibility to buyout rumors. Many short-term traders rely exclusively on price action to make trading decisions.

Many technical analysts use price action when calculating technical indicators or identifying chart. The goal is to find order in the sometimes seemingly random movement of price. For example, an ascending triangle pattern may be used to predict a potential breakout since the price action indicates that bulls have attempted a breakout on several occasions and have gained momentum each time.

Interpreting price action is very subjective. It’s common for two traders to arrive at different conclusions when analyzing the same price action. One trader may see a bearish down trend and another might believe that the price action shows a potential near-term turnaround. As a result, many traders would be better off using price action as just one part of a larger strategy.

Price action trading involves placing trades exclusively based on price action rather than fundamental or technical analysis. Swings (high and low), support and resistance levels, and breakouts and consolidation are some examples of price action. For instance, a short-term trader may watch for a price to breakout from a prior price that occurred on high volume before taking a long position.

Price action trading is most common among retail and institutional traders, although it’s becoming less popular with the rise of algorithmic and high frequency trading. Many pattern day traders will place very large trades, often with the use of leverage, using price action as their only guide with the goal of generating a profit from very small underlying movements. Technical analysis and fundamental analysis aren’t especially useful in these cases given the very short-term nature of the price movements, but price action can provide some helpful clues into supply and demand balances.

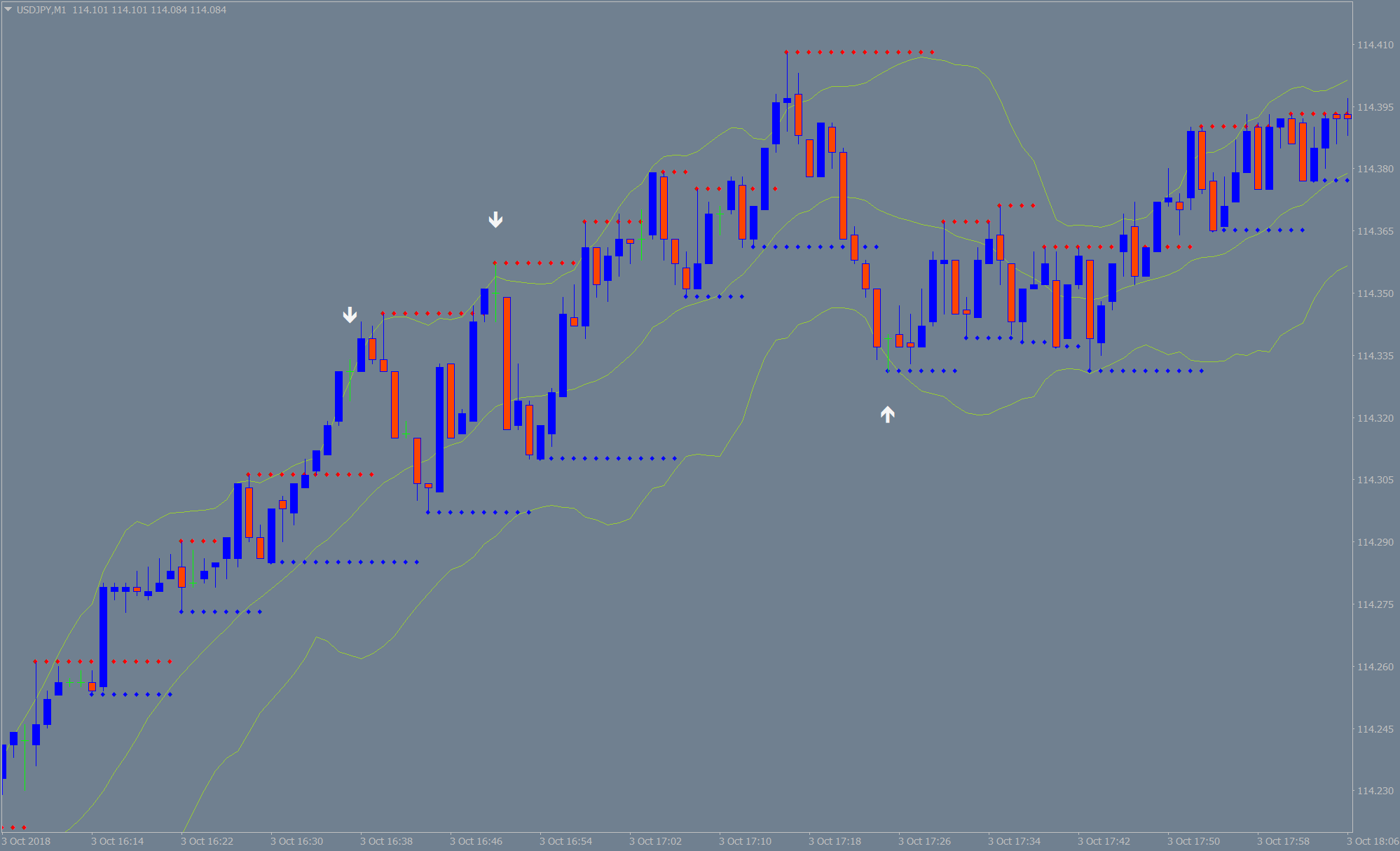

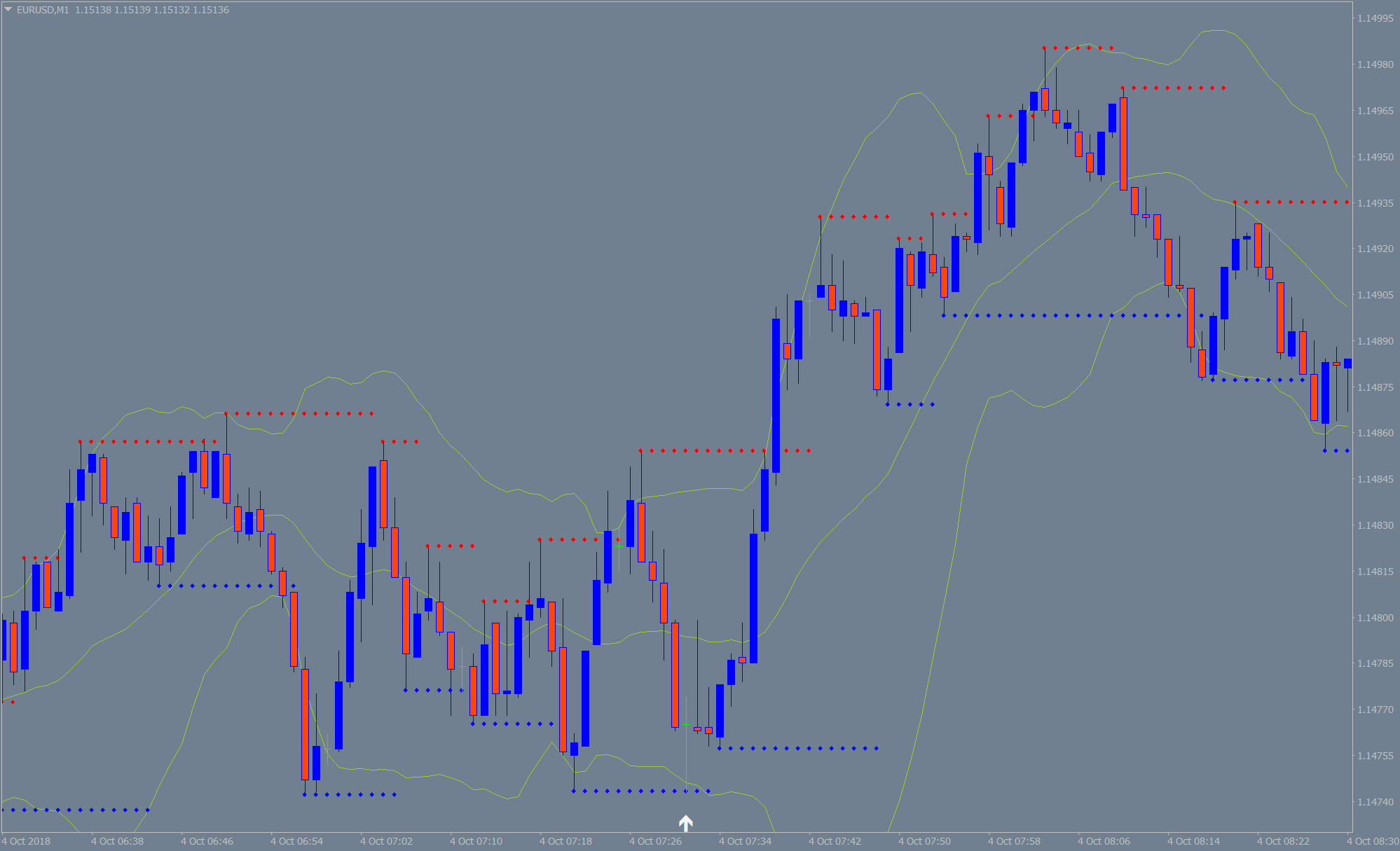

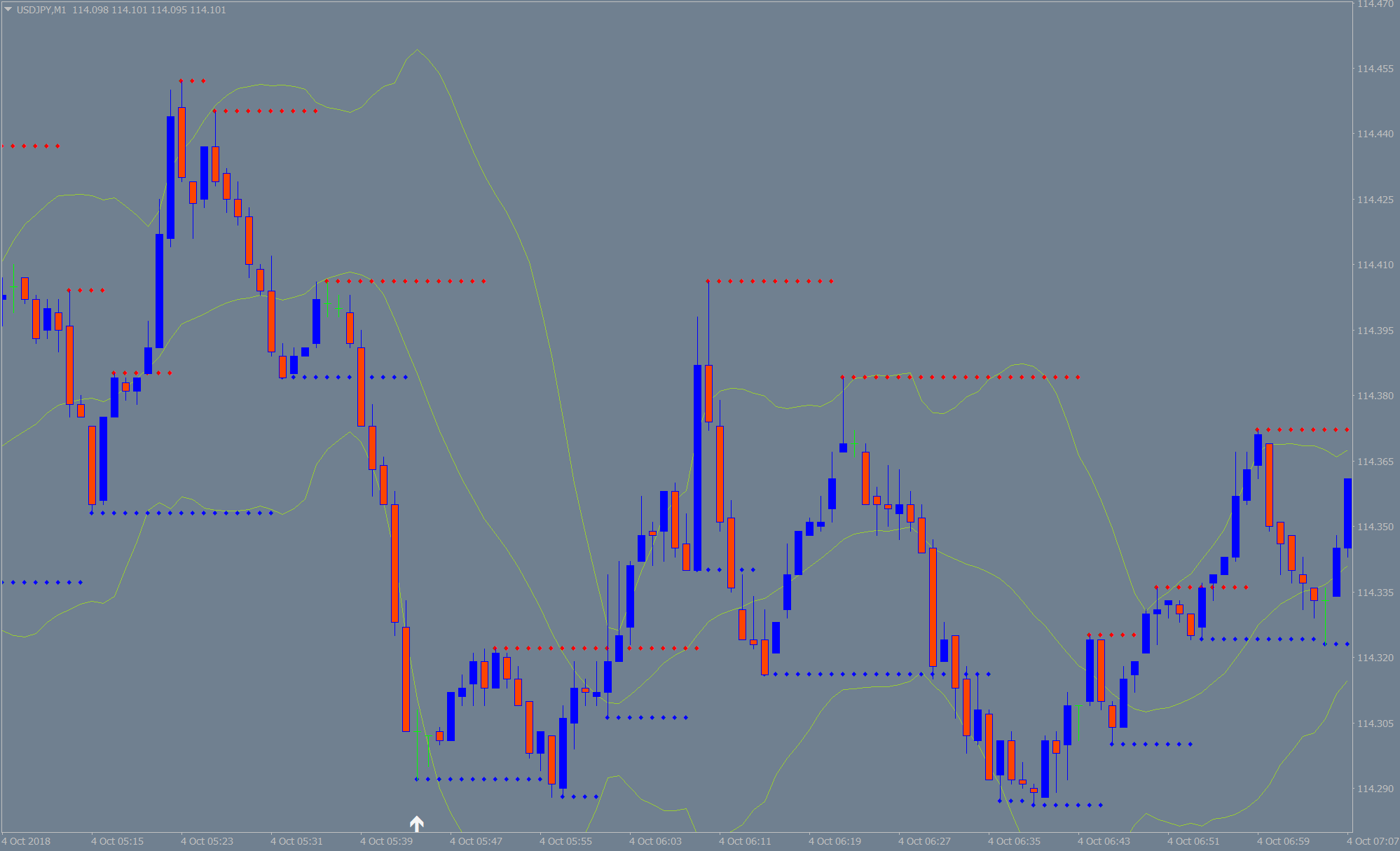

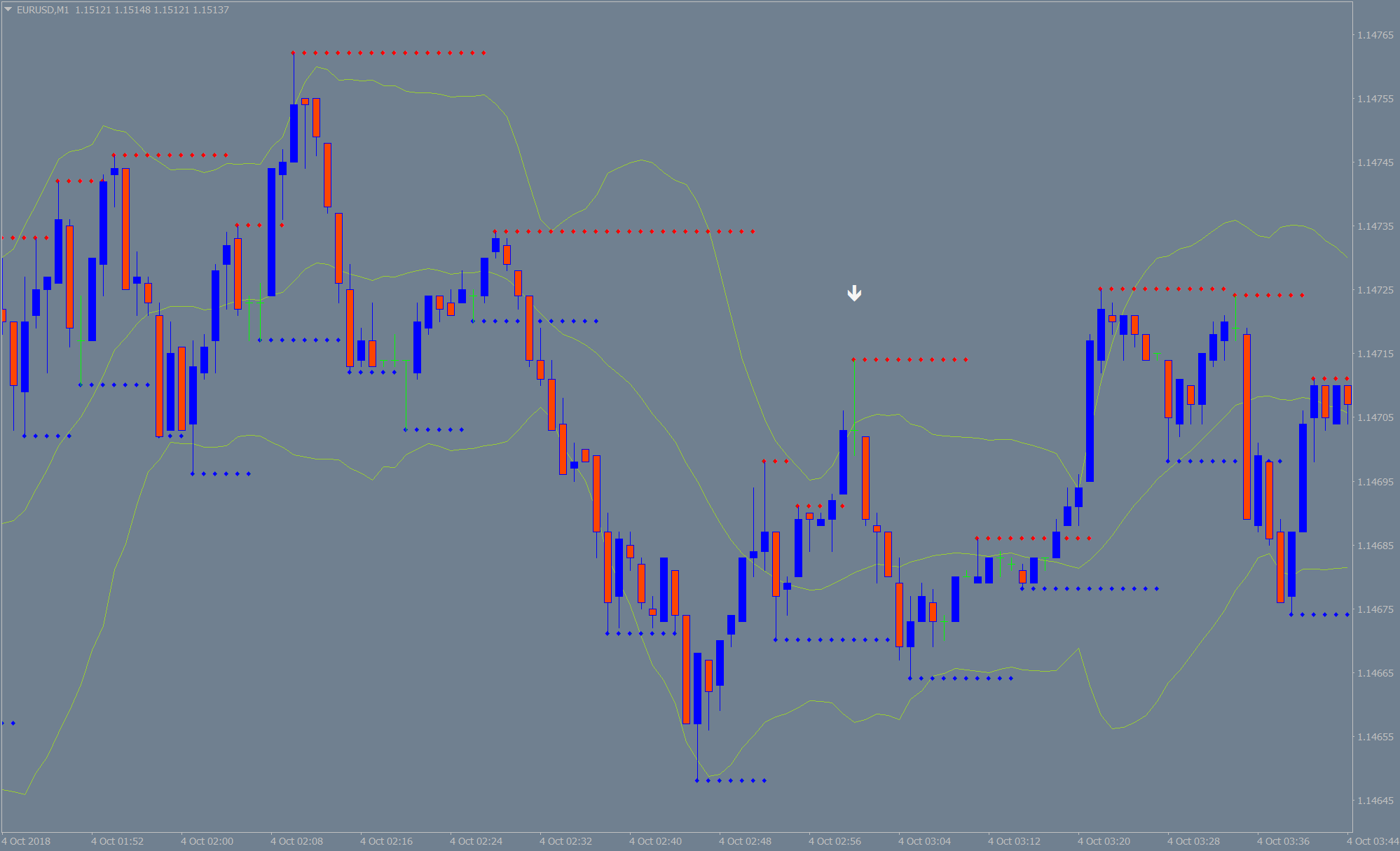

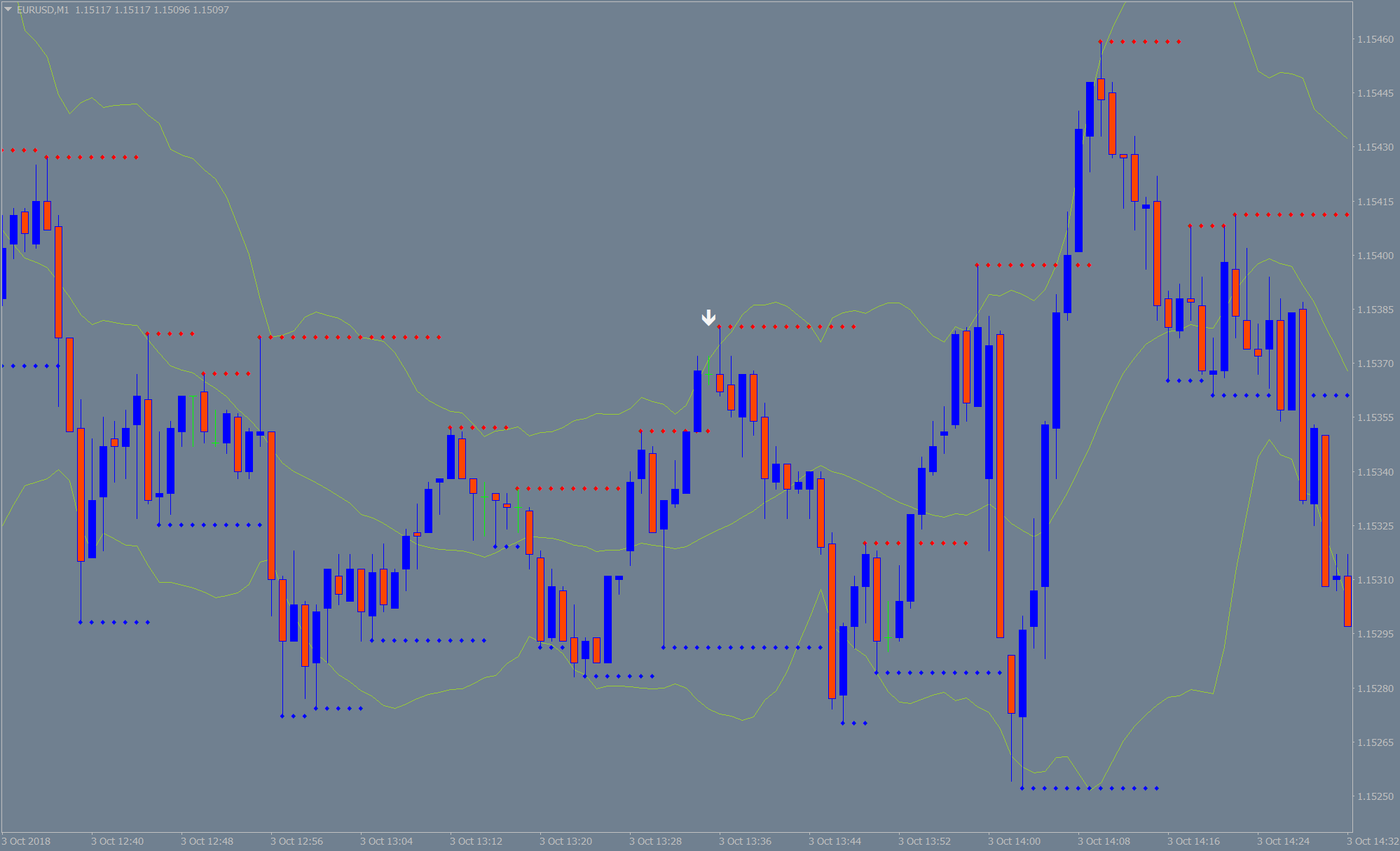

The FX OXE Binary Price Action incorporates all price action patterns including support and resistance break outs based on demand and supply, rejection on key levels, strength and over bought and over sold exhaustion.

Non Repaint, Non Disappearing, Non Back painting

Indicator gives non repaint arrow signals in line with market conditions.

Arrow Signals

The Indicator gives clear arrow signals. Just take the signal, nothing else……

Trading Time Frame & Expiry

Price Action Algo for binary is programmed to work best on a 1M time-frame and 5M expiry. Although in ranging markets or trades against trend, smaller 2M expires may also be taken.

Signals Frequency

4-5 signals per pair per day.

Monthly Rental

- Control over your money

- Works with 1MT4 A/c

- Complete transparency

- Vulnerable environment

- Improved Privacy

- Renewable

Lifetime License

- Lifetime License

- Works with 2MT4 A/c

- Complete transparency

- Vulnerable environment

- Improved privacy

- Full control over fees

Volume License

- Lifetime License

- Full validation

- Complete transparency

- Vulnerable environment

- Improved privacy

- Full control over fees