Currently Empty: €0.00

OXE Binary S&R Algo

- Home

- OXE Binary S&R Algo

OXE Binary S&R Algo

Support is where the price tends to stop falling, and resistance is where the price tends to stop rising. Yet, trying to make trading decisions based on this vague definition will likely lead to a depleted trading account.

To use support and resistance effectively we first need to understand how asset prices typically move, so we can then interpret support and resistance from that framework. There are also different types of support and resistance, such as minor and major/strong. We expect minor levels to be broken, while strong levels are more likely to hold and cause the price to move in the other direction. With this information we can start making better decisions based on support and resistance.

If the price is trending lower, it will make a low, then bounce, and then start to drop again. But if the trend is down, the price is likely to eventually fall through that minor support level without much problem.

Minor support or resistance provide analytical insight, and potential trading opportunities. If the price does drop below the minor support level then we know the downtrend is still intact. But, if the price stalls and bounces at or near the former low then a range could be developing. If the price stalls and bounces above the prior low then we have a higher low and that is an indication of a possible trend change.

Major support and resistance are price areas that have caused a trend reversal recently. If the price was trending higher and then reversed into a downtrend, where the price reversed from is a strong resistance level. Where a downtrend ends and an uptrend begins is a strong support level.

When the price comes back to a major support or resistance area it will often struggle to break through it and move back in the other direction. For example, if the price falls to a strong support level, it will often bounce upward off it. The price may eventually break through it, but typically the price retreats from the level a number of times before doing so.

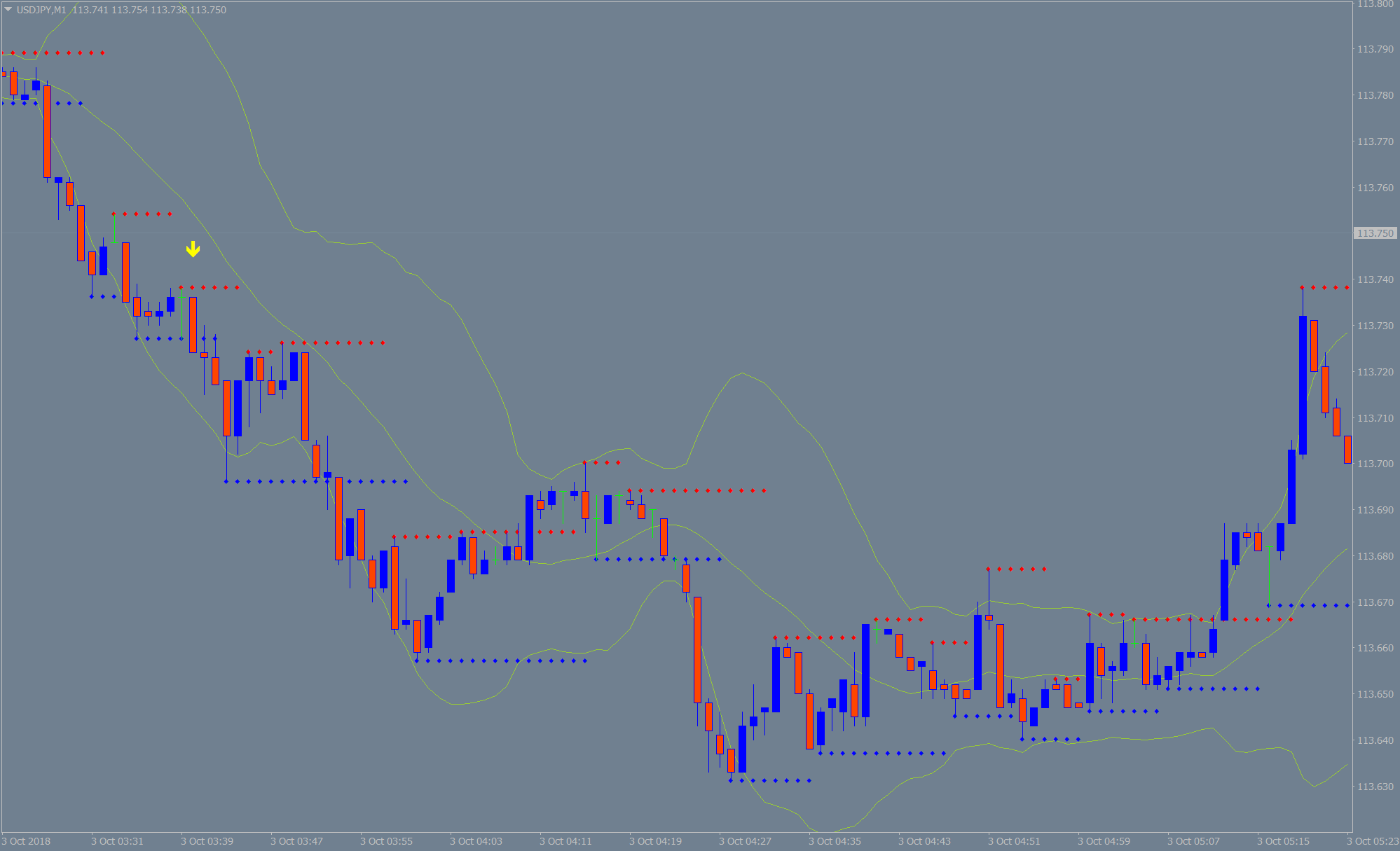

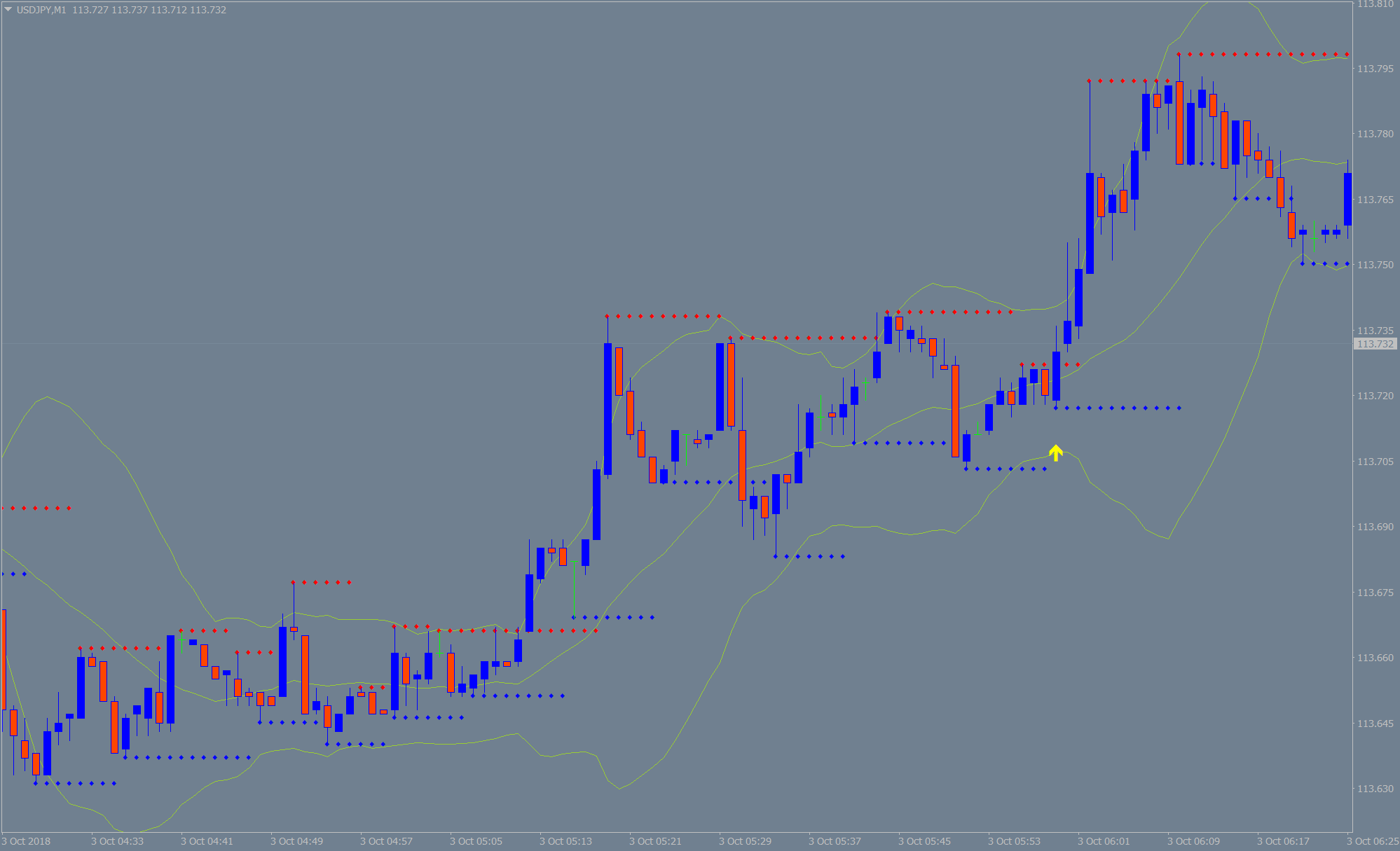

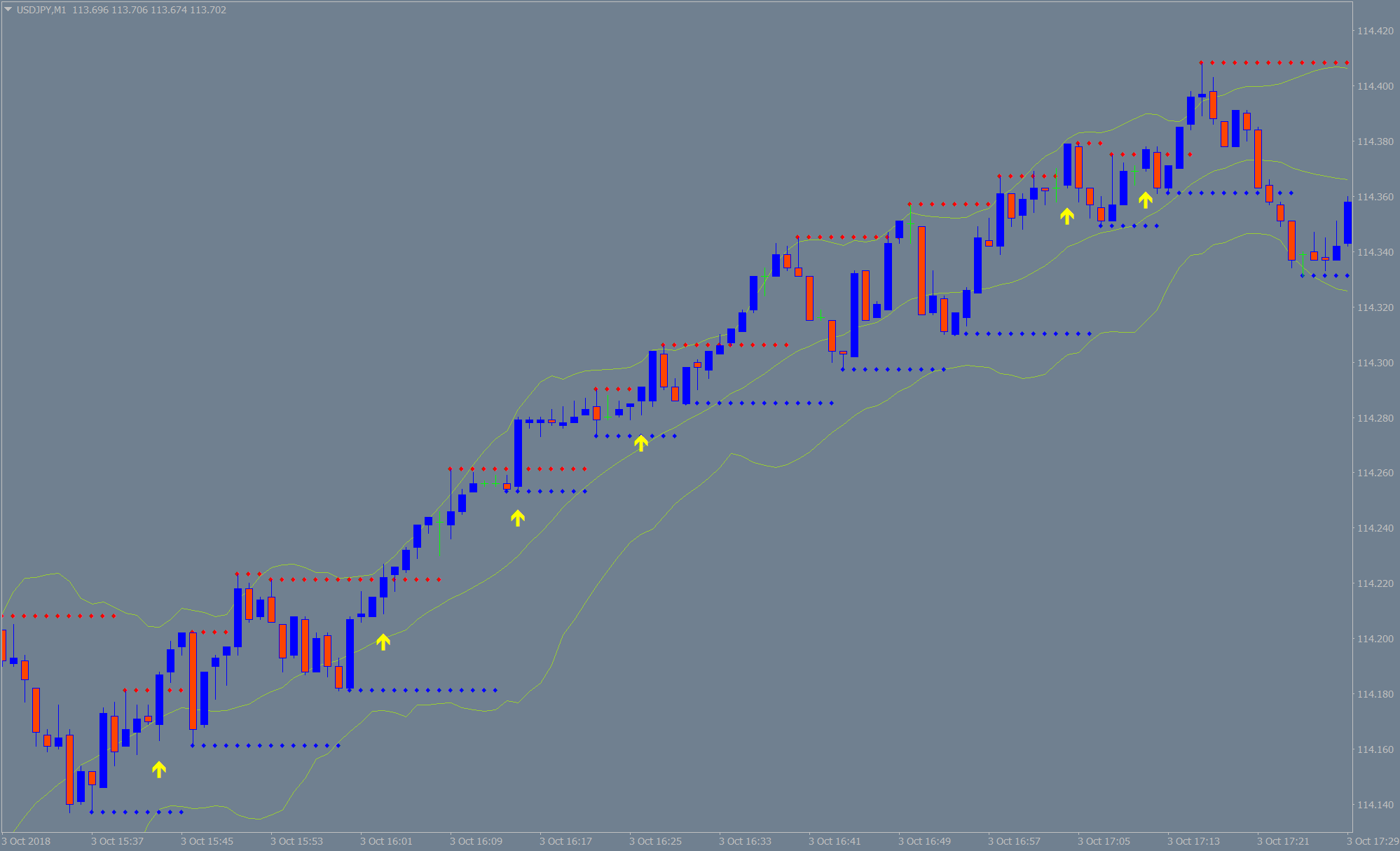

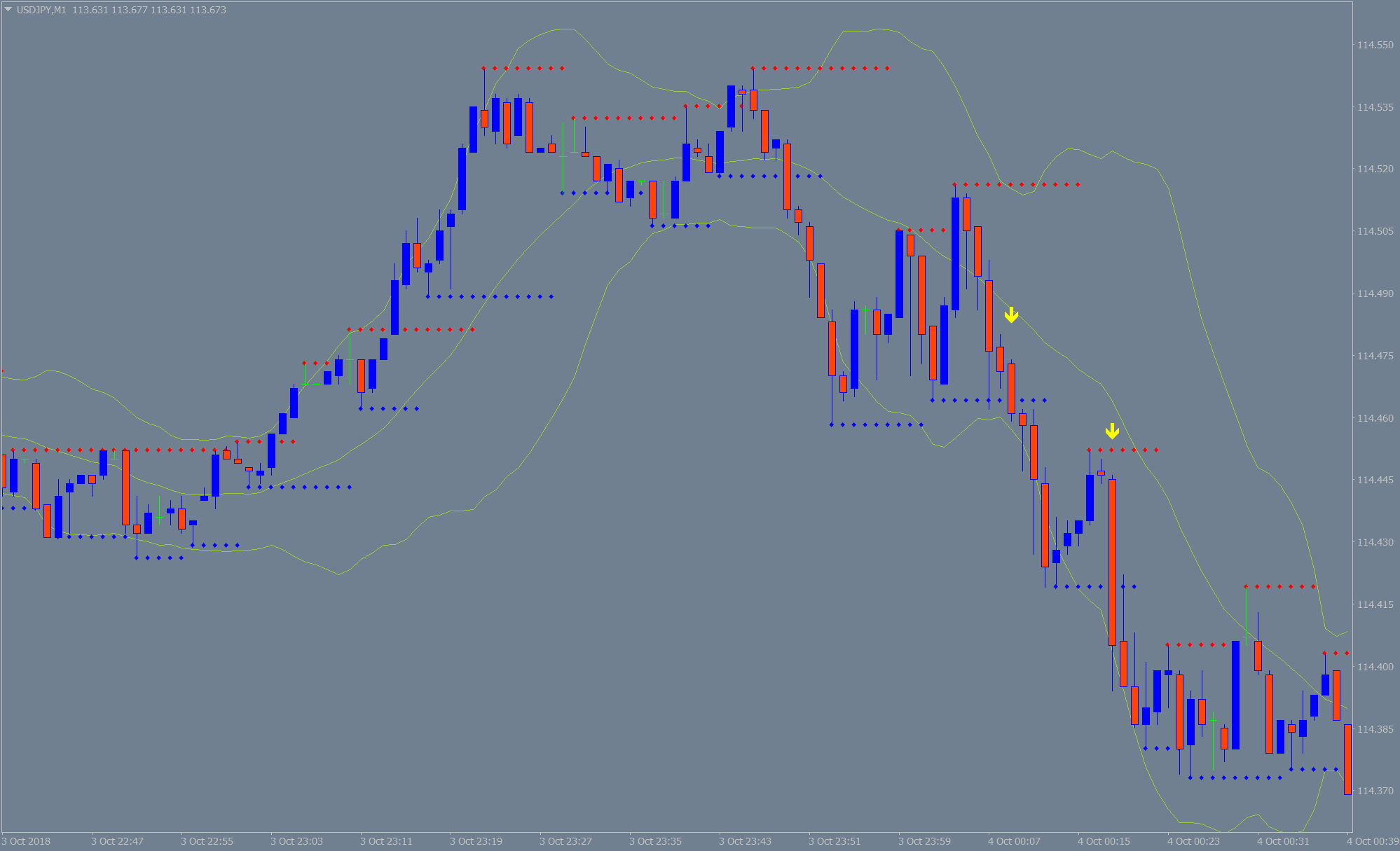

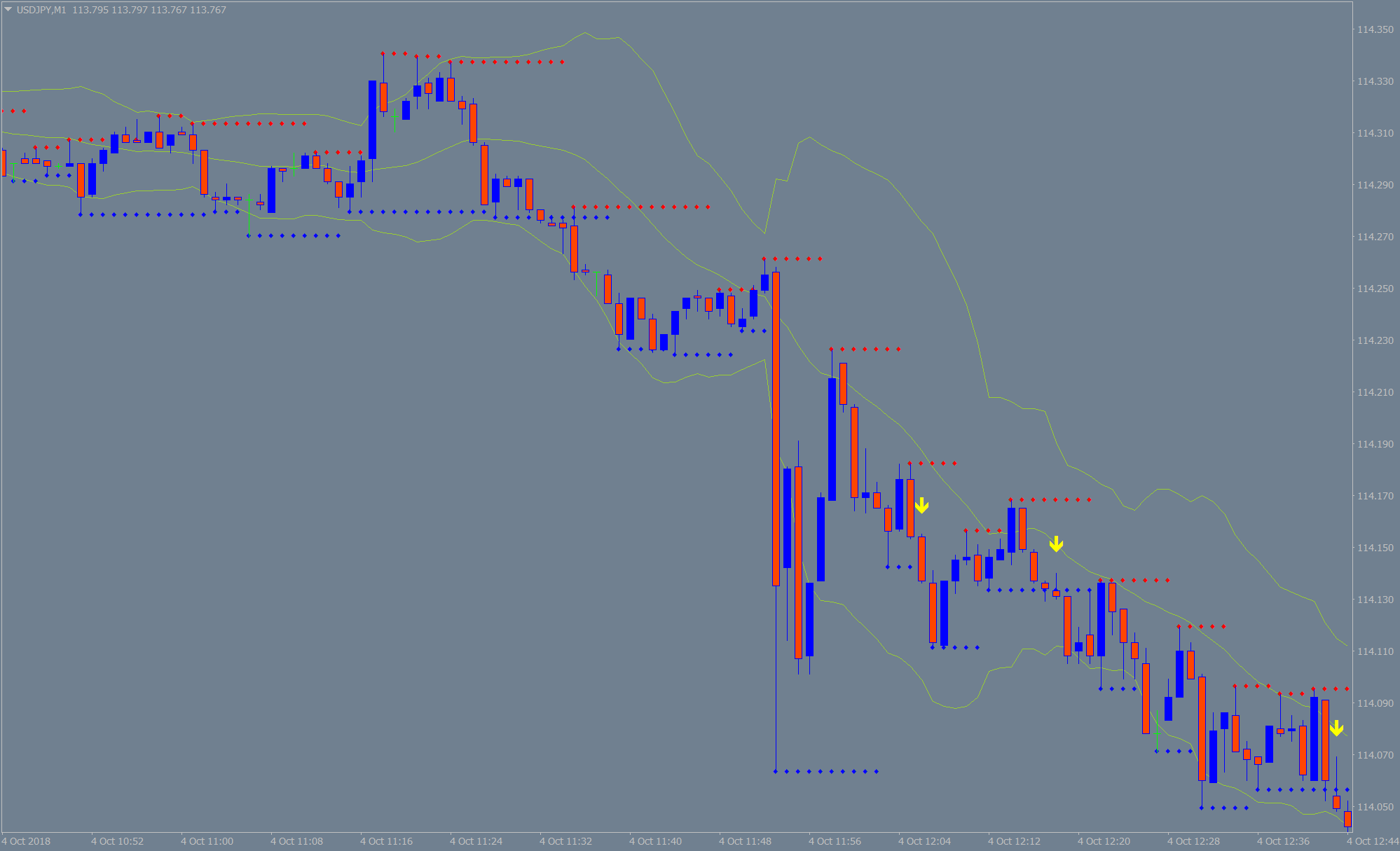

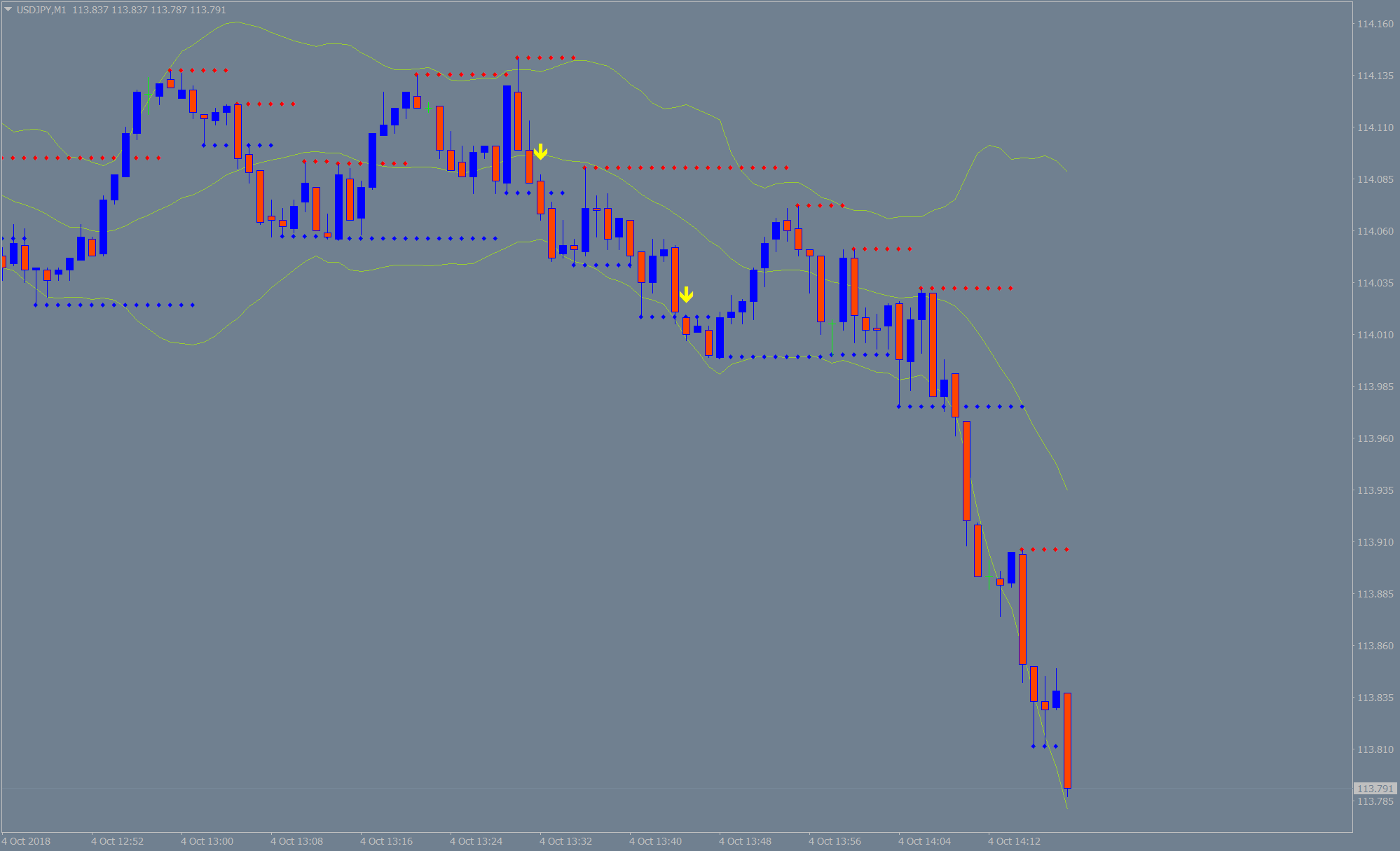

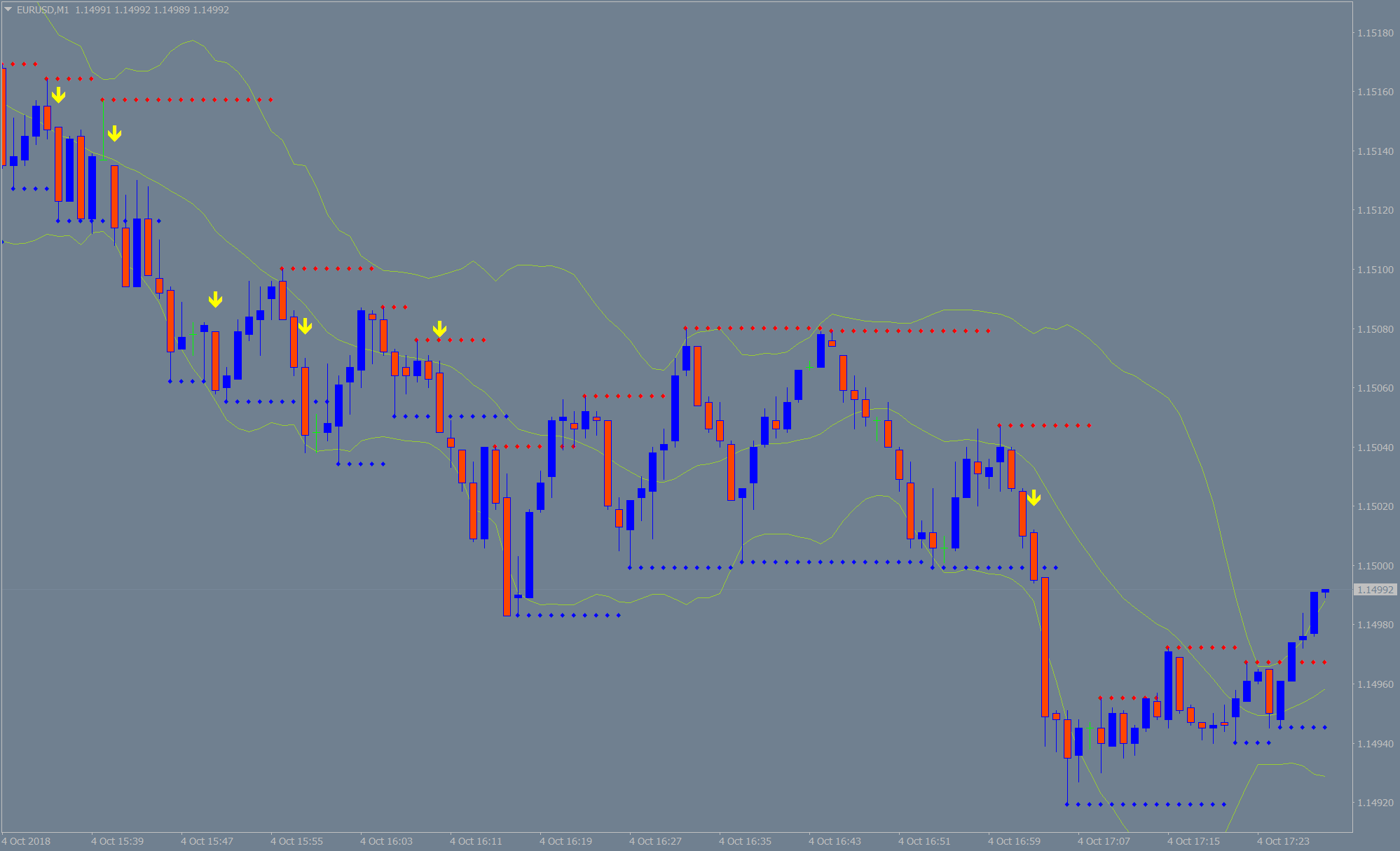

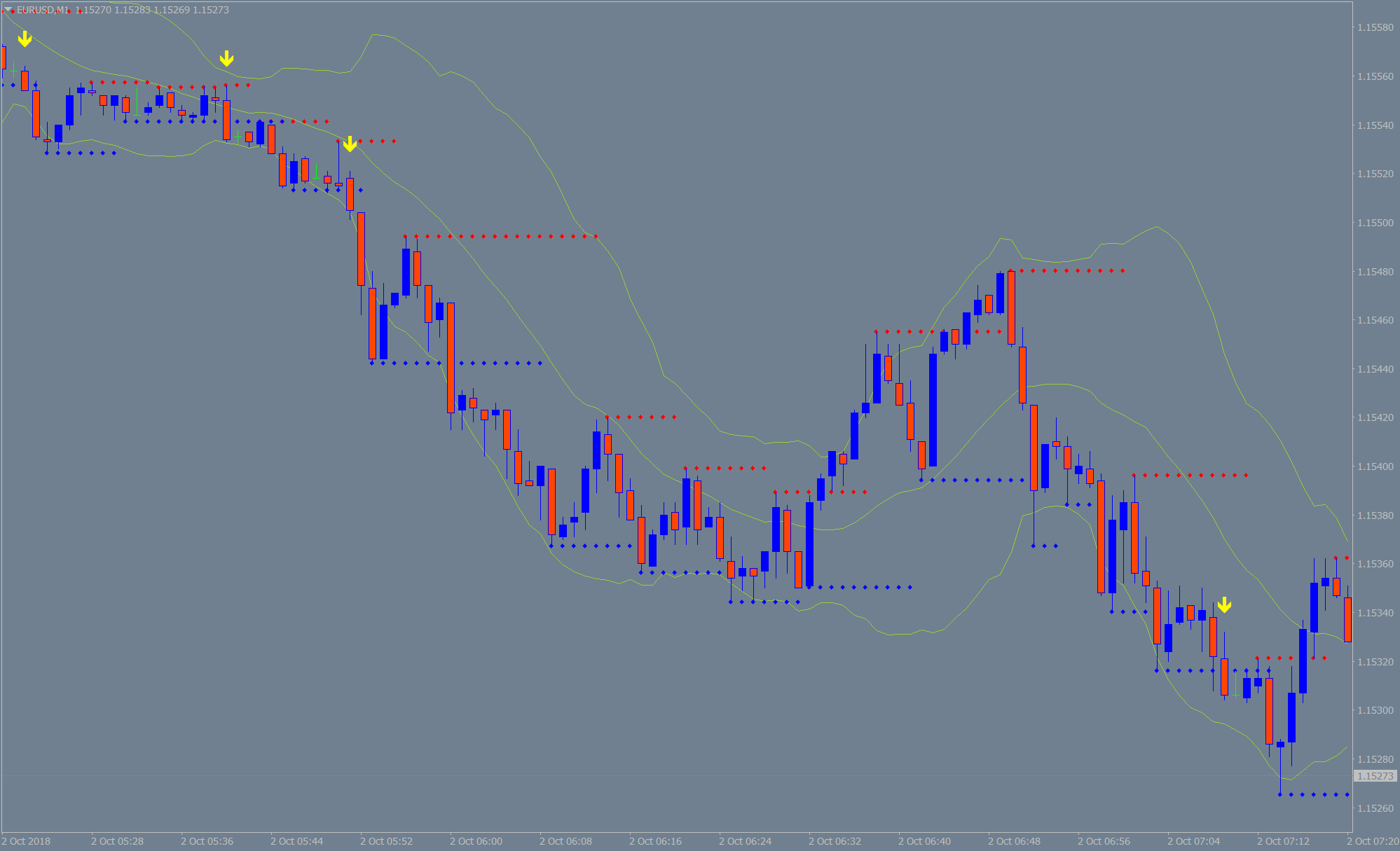

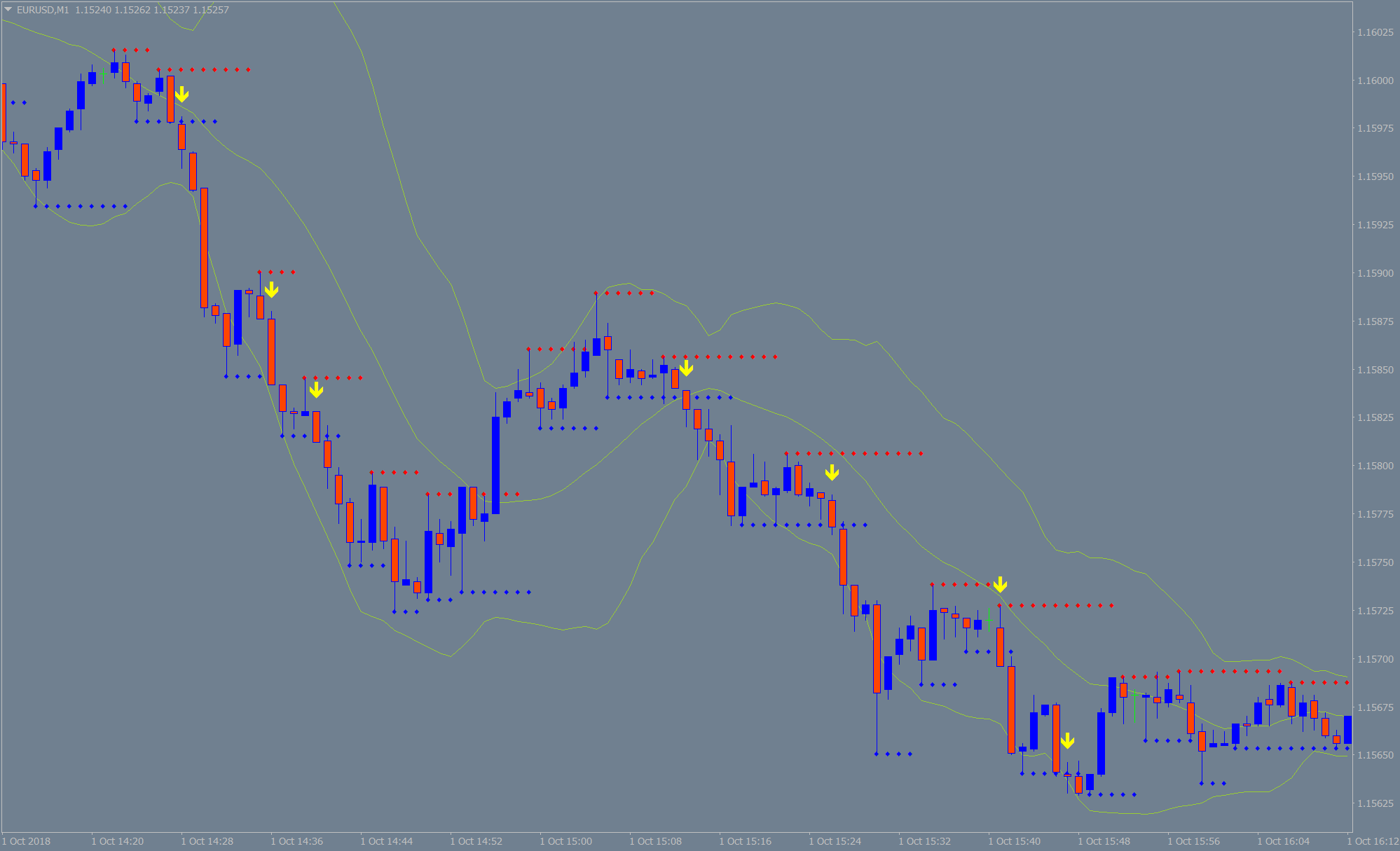

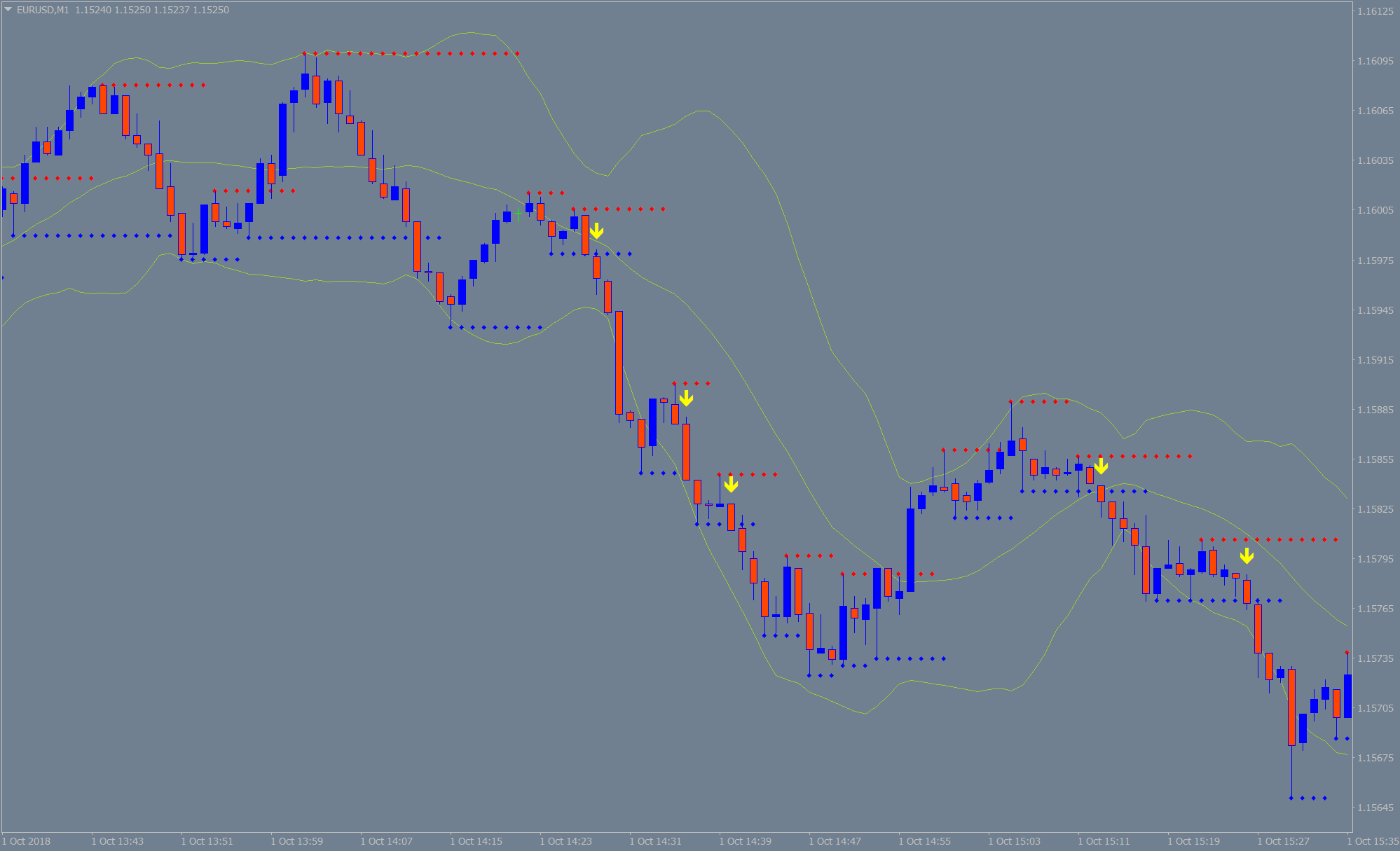

The FX OXE S&R Indicator is a magical coding that incorporates price movement along keys levels of support and resistance. It looks at potential break outs, pull backs, bounce offs rejection and much more. It does this considering volatility of the market including volume and strength. A high volume in a volatile market would be more geared up to break key levels of support or resistance rather than a relatively quieter market. The indicator also considers price action on key levels to confirm possible break outs or rejections.

Non Repaint, Non Disappearing, Non Back painting

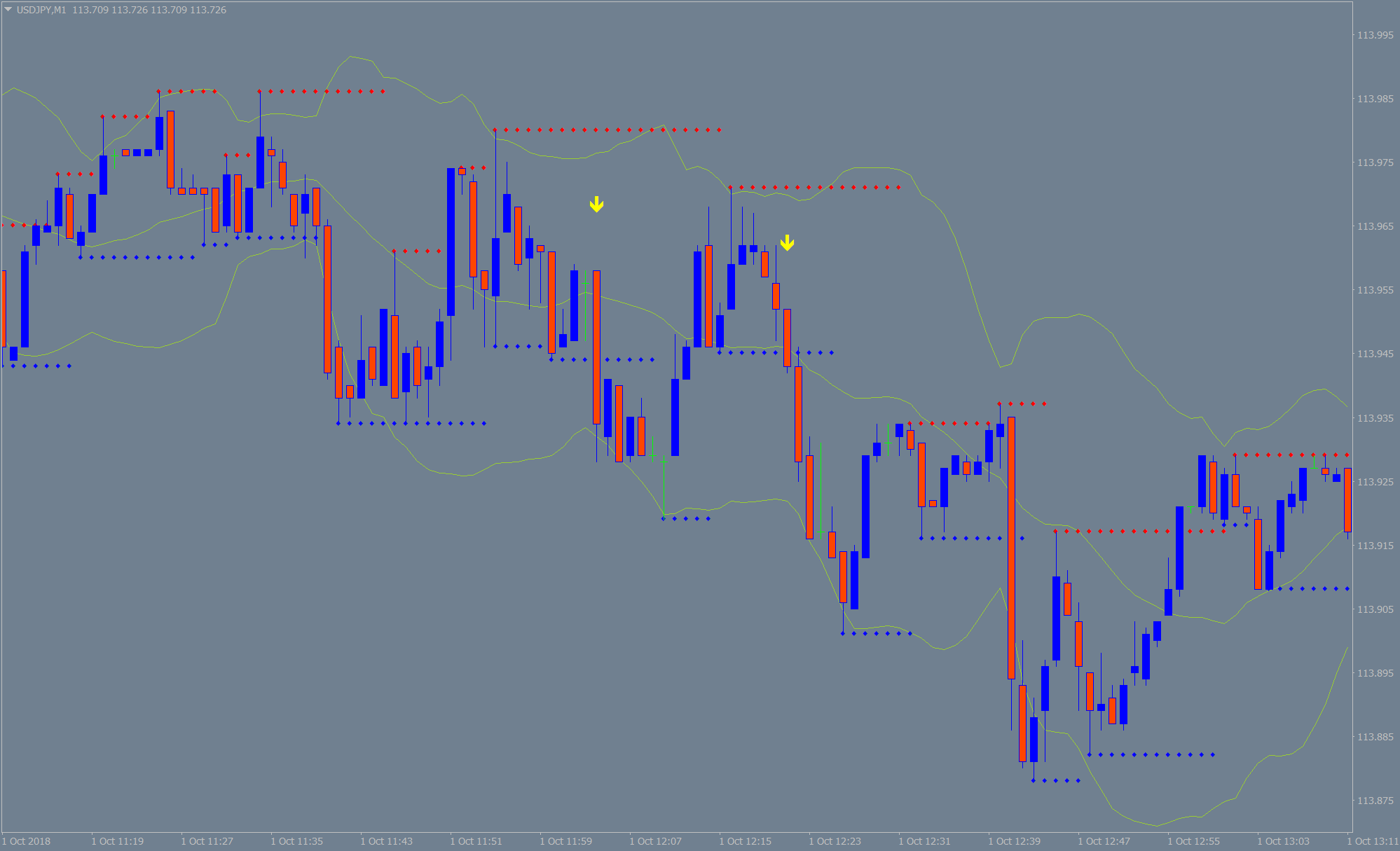

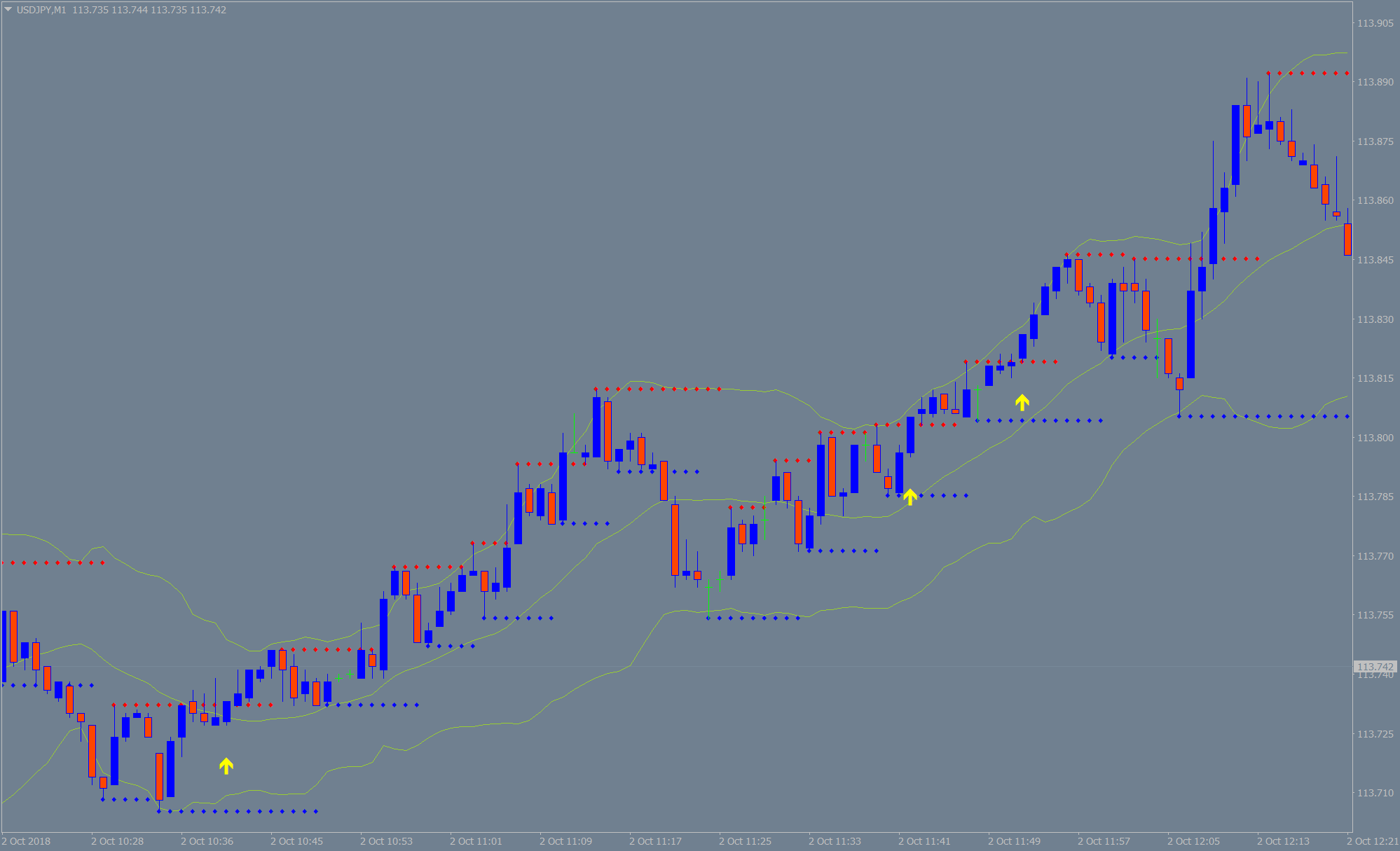

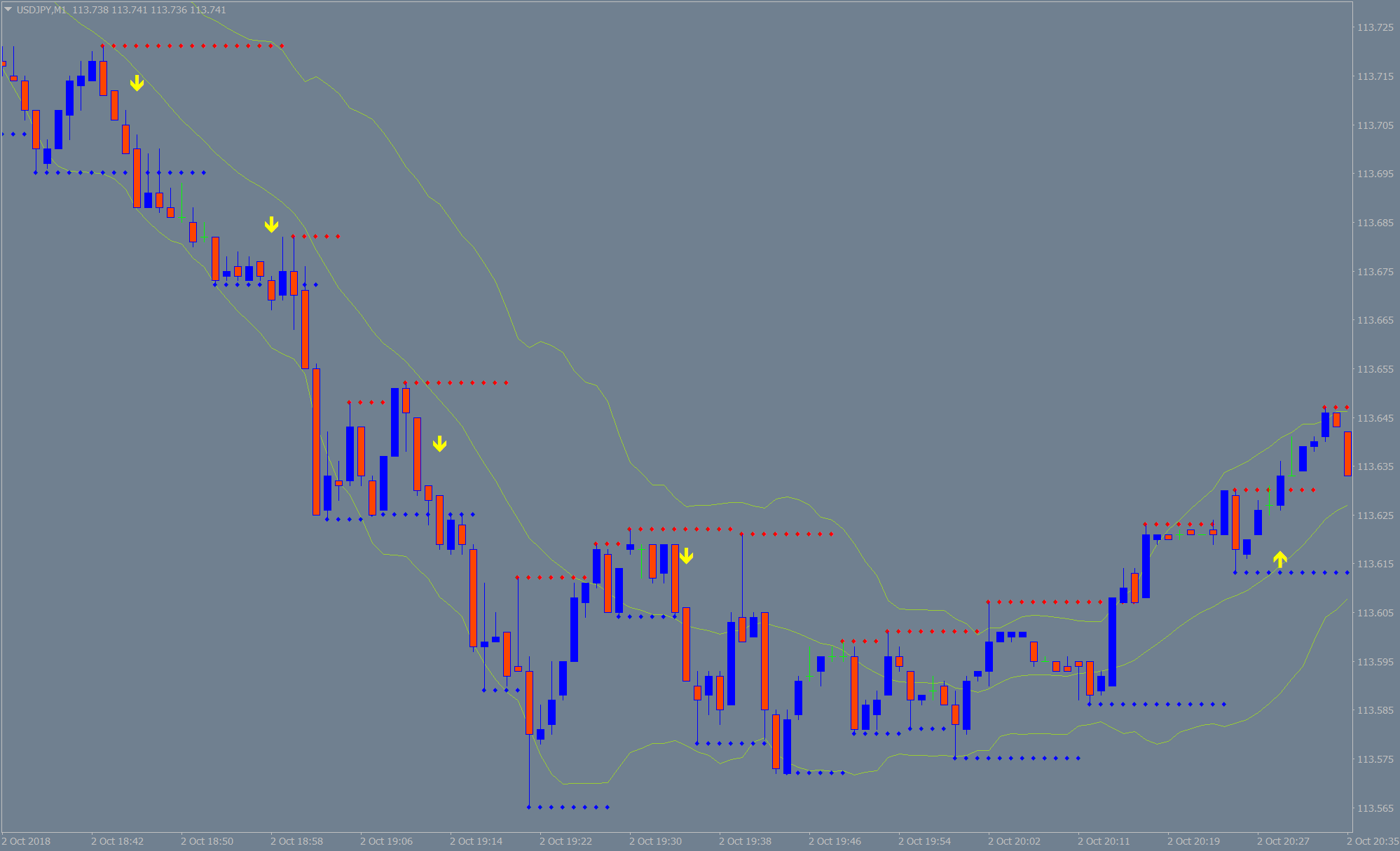

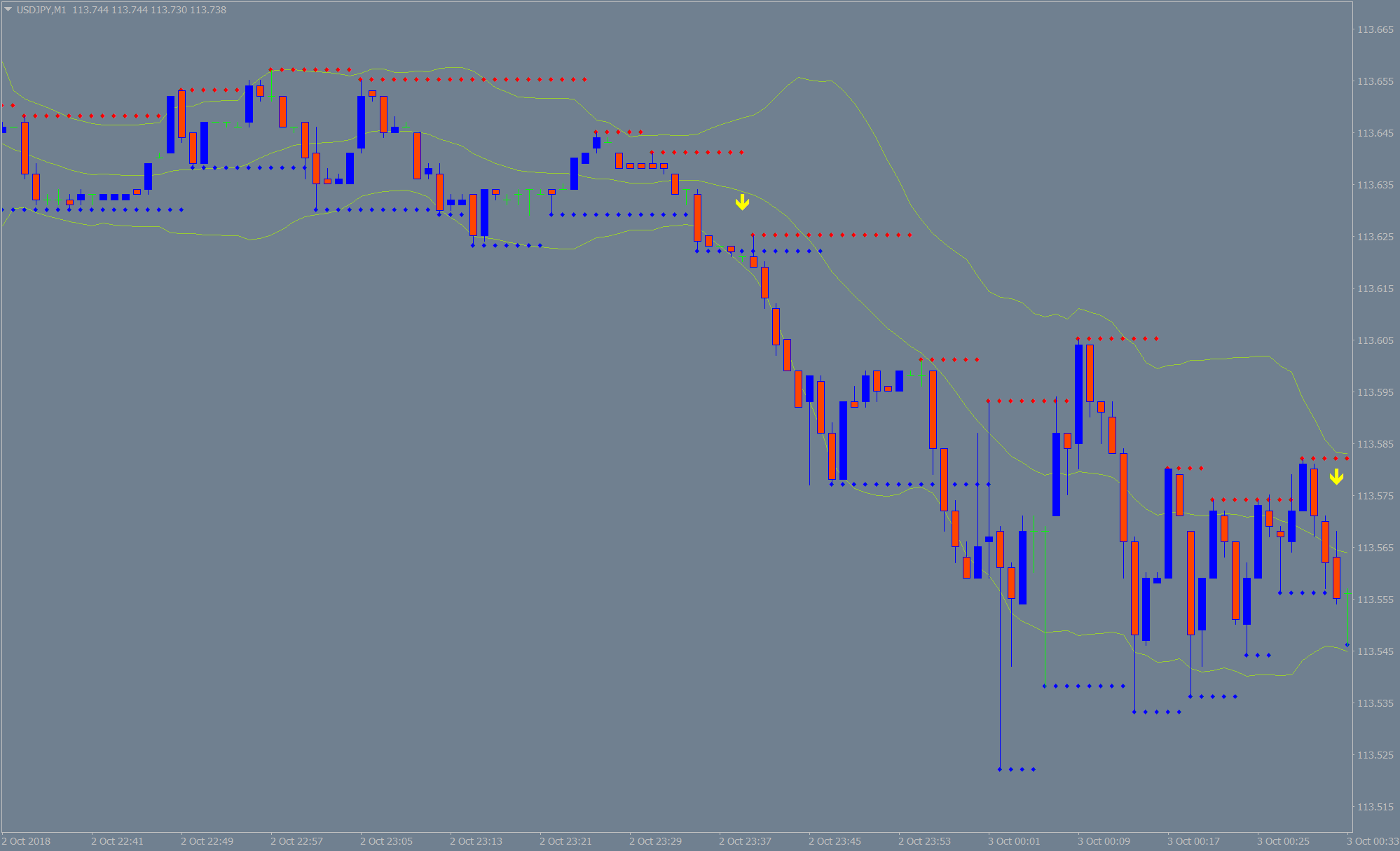

Indicator gives non repaint arrow signals in line with market conditions.

Arrow Signals

The Indicator gives clear arrow signals. Just take the signal, nothing else……

Trading Time Frame & Expiry

OXE S&R Algo for binary is programmed to work best on a 1M time-frame with 1M to 2M expiry. OXE recommends a 5M expiry.

Signal Frequency

15-20 signals per pair per day.

Monthly Rental

- Control over your money

- Works with 1MT4 A/c

- Complete transparency

- Vulnerable environment

- Improved Privacy

- Renewable

Lifetime License

- Lifetime License

- Works with 2MT4 A/c

- Complete transparency

- Vulnerable environment

- Improved privacy

- Full control over fees

Volume License

- Lifetime License

- Full validation

- Complete transparency

- Vulnerable environment

- Improved privacy

- Full control over fees